|

|

|

|

Cause of the CRASH is the Fed Reserve bank’s loan policy, which greatly expanded the amount of debt.

"A democracy exists whenever those who are free and poor

are in sovereign control of the government; an oligarchy when the control lies in the hands of the rich and better born.”—Aristotle

Don’t miss the collection of Pod Cast links

Table 1. Domestic debt* and GDP (Trillions of dollars)

|

|

GDP** |

Total debt |

Household |

Financial

firms |

Non-financial

Firms |

Governments

State-local-fed |

|

1970 |

1..0 |

1.5 |

0.5 |

0.1 |

0.5 |

0.4 |

|

1980 |

2.7 |

4.5 |

1.4 |

0.6 |

1.5 |

1.1 |

|

1990 |

5.8 |

13.5 |

3.6 |

2.6 |

3.7 |

3.5 |

|

2000 |

9.8 |

26.3 |

7.0 |

8.1 |

6.6 |

4.6 |

|

2007 |

13.8 |

47 |

13.8 |

16.0 |

10.6 |

7.3 |

* The federal part of local, state, and federal debt includes only

that portion held by the public. The total debt in 2007 when the federal debt

held by federal agencies is added totaled $51.5 trillion.

** Inflated because instead of measuring just growth in material wealth, it includes also profits in the financial

sector—as though this was derived from the making of durable good. In fact

the average American has less purchasing power today than in 1970. Material wealth

has not grown as fast as population. It also isn't in constant dollars.

On Naming the same

Necon, neoconservative, neoliberal (the term used in Europe), globalizers, flat worlders,

free market profiteers, robber barons, and lassie fare capitalists

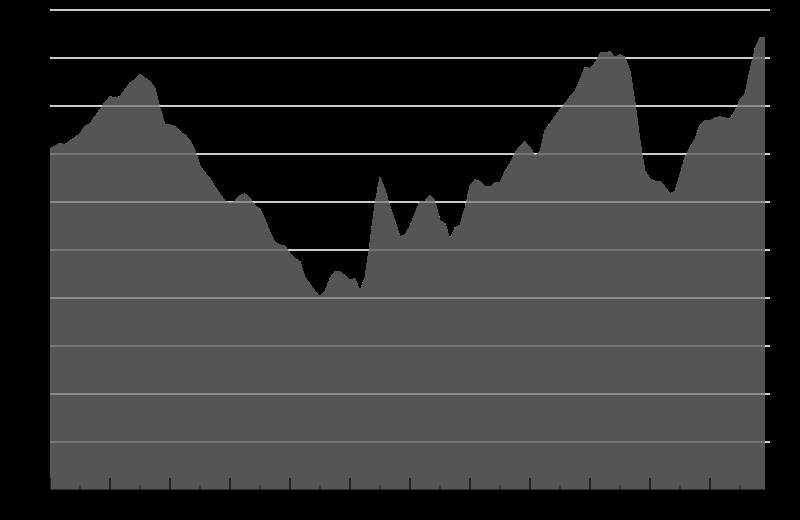

| Industrial production1928 to 1939 |

|

The core is rotten--jk 10/3/8

Before reading this article, look at the 1st chart

at http://skeptically.org/crash/id16.html and the one below Morgan at http://skeptically.org/crash/ on the expansion of funds U.S., there are similar charts for nearly all nations—Reaganomics is a global (IMF)

plague.

The Core is Rotten--jk 10/3/8, 11/30/8, 4/23/9

Pumping money into the banking system will not avert a second

great depression, for the principle cause is the Federal Reserve Banking System and their policy 10% fractional asset requirement

of member banks. This policy has permitted the supply of money to multiply. The

more money ran through the Federal Reserve and member banks the more profits they make through loans. A dozen other factors pushed forward the clock: especially falling buying power of workers and debt overload (federal, consumer, housing, and commercial). Other major causes include the loss of manufacturing, trade deficits, the outsourcing

of jobs, housing bubble, drop in value of stocks and pension plans, rising unemployment, supporting a gigantic financial sector,

a military budget greater than all the other nations of this world’s combined, and the worlds most costly medical system.

Propping up housing prices and the financial sector is only delays the collapse. Ideologs

undid the strong dollar policy of Clinton and the Democrats. In 01, with the

fed debt at $5 trillion, and the Republicans drastically cut taxes on businesses and the top 1%, while waging a war.

At $11 trillion dollars in 08, the fed debt is unsustainable; so too are unsustainable commercial and manufacturing

at over $20 trillion, and consumers’ at over $13 trillion. The trade deficit in 07 was over $60 billion per month.

Total debt in the U.S. totals $53 trillion (Sept. 08). And there is on top

of this the shadow banking sector, which has in 08 was over $60 trillion. Our government has responded by further expanding the currency through new

debt owed to the banks, which they then return to the banks like a form of welfare.

Debt is the problem more debt is not the long-term fix.

Read the long version of this at http://skeptically.org/crash/id23.html

|

|

|

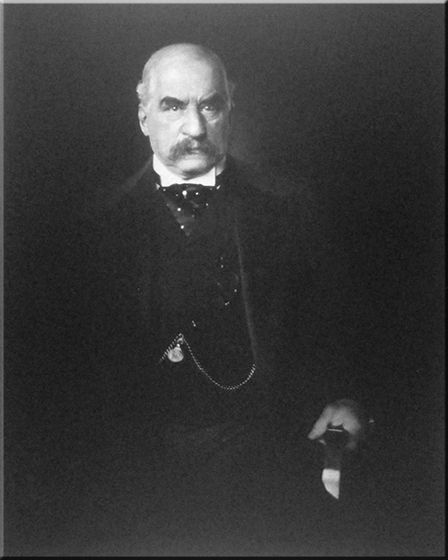

| J.P. Morgan |

|

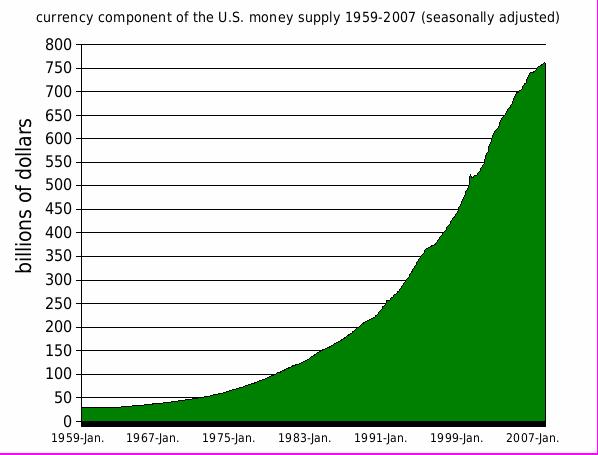

| Flooding the economy with dollars |

|

The chart above says it all

Cause of the CRASH is the

Fed Reserve bank’s loan policy, which greatly expanded the amount of debt.

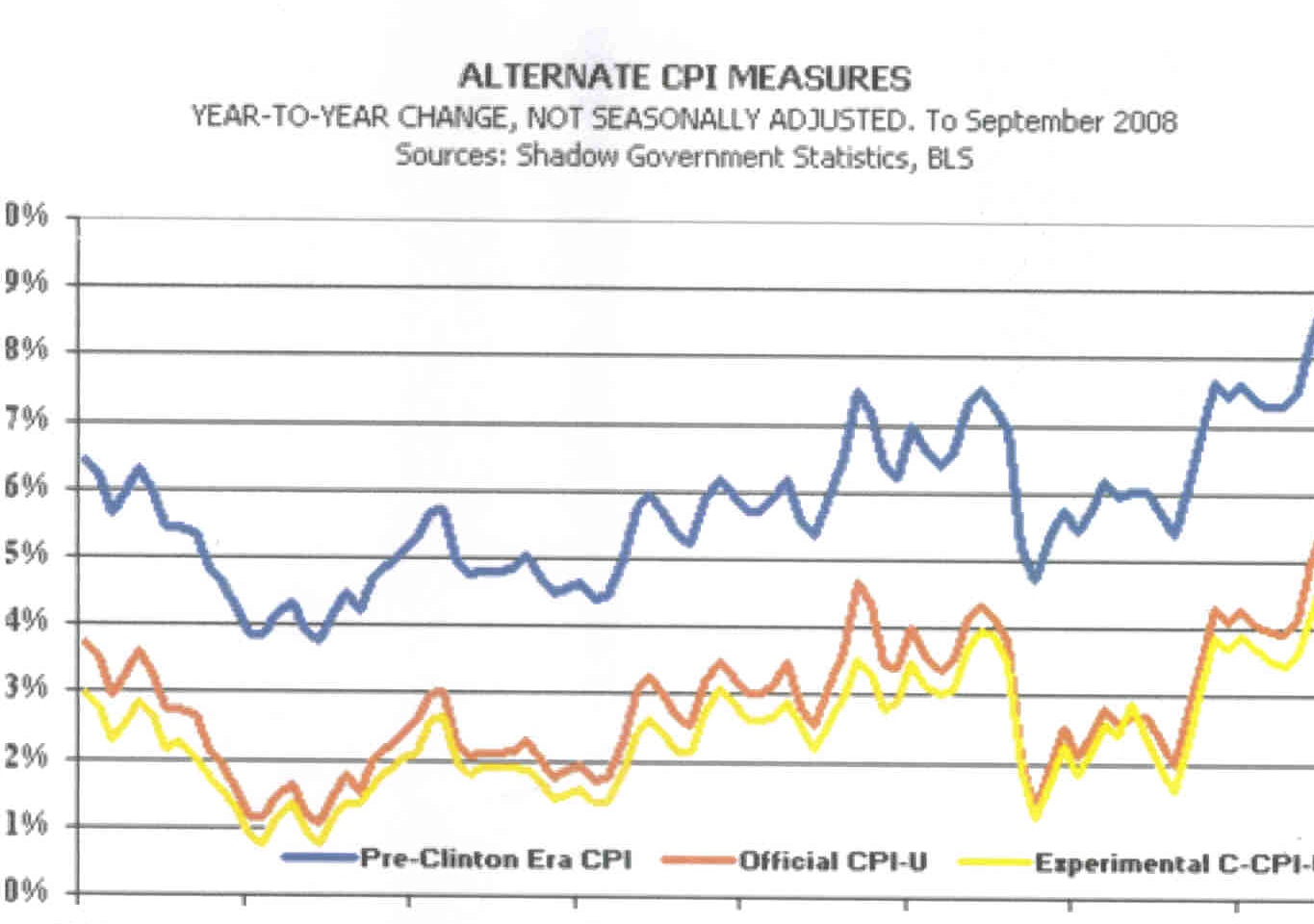

| Don't believe the Fed numbers |

|

| link to shadow stats article (bottom) |

The current Consumer Price Index increase (using pre 1976 basket of goods) for this year (November 08) is 13%, not the

under 4% reported. We are getting poorer faster than the government reports. Social Security payment drop in real

dollars, as does wages, bank accounts, brokerage accounts, housing equity, and so on.

It is not a housing bubble, but rather as Joseph Stiglitz (noble laureate

in economics) states was a money bubble. The U.S.

avoided a wartime recession built upon oil going form $23/ barrel to $100. This

dollar flood, as the above chart shows was dispersed through the Federal Reserve to banks, and then to the loan market of

which housing and credit cards were the largest recipients—which by the way, the credit-card bubble bursting will be

next.

Joseph

Stiglitz, Globalization and its discontents, 2002, http://en.wikipedia.org/wiki/Globalization_and_Its_Discontents

This site is

one of 3 sites maintained by California Skeptics

All with cool

art and informative articles

A = Art with some of the articles. All home

pages have art.

#7 TABLE OF CONTENTS

skeptically, a dozen major topic, over 1,000 articles, averages over 9,000 pages downloaded per weekday.

#201 TABLE OF CONTENTS FOR CURRENT NEWS ISSUES, 900 current

political news, international news, corporate news & archives—over 600 pages downloaded per day A

#31 TABLE OF CONTENTS healthfully, 1,000 health & medical articles, many topics, averages over 1,000 pages downloaded per day. A

#209 THE ARTISTS, bios and samples of their art A

# 220 VIDCASTS & U-TUBE, for those who like the visuals A

#1 Enlightenment, our favorites,

the flagship articles A

Political-economic sites:

#111 World Trade, World Bank, Privatization A

#123 Neoliberalism at Work A

#125 The Crash

A

#131 The Depression

#133 Banking History & Effects

#135 Globalization

#136 Populism

#106 Economics

A

#119 Economic

Developments A

#121 Economics the Dismal Science

#132 Economic Graphs A

#23 Critical of Capitalism A

#116

OIL

A

#128 Terrorism Hegemony

#126

Corporate system

#139

Government Sold Off

#129 Obama Watch

#134 Democrats Obama

#21 Muckraking Political Articles

#103 Parliament of Whores A

#104 Government, Presidency, Congress, Courts

#117 Federal Court System

#12 Penal

System

#28 Nuclear War Threat A

#118

Iraq war &

Wars A

#127 Military War

#138

Genocides

#140

Education dismantled

#120

Election Reform A

#124 Managed-Corporate Press

#2 Utopia A

#14 Labor A

#41 Medical

Business Abuses

#130

Big Pharma at Work

#137

Food Inc.

#25 Bush

Bashing

#112 Bush Watch A

Current news issues: A

#201 INDEX FOR

CURRENT NEWS ISSUES

#228 POLITICAL

NEWS—DECEMBER OF 2012 TO FEBRUARY OF 2013

#227 POLITIAL

NEWS--SEPTEMBER TO NOVEMBER OF 2012

#226 POLITICAL

NEWS—JUNE TO AUGUST 2012

#225 POLITICAL

NEWS—MARCH TO MAY OF 2012

#204 CARTOON

GALLERY

#209 THE ARTISTS

#202 South America

#208 Peoples’

socialist movements

#203 Corporate

#210 International news

#231 U.S. International Policy

#211 Vote counting fraud

#230 Washington Watch

|

|

|

| Oct 1928 to Oct 1930 Stockmarket |

|

|

|

|

|

Enter secondary content here

|

|

|

|

|

|

|

The fruits of globalization

Since Bush has been president (until Oct 1, 2008):

- Over 10 million people have slipped into poverty;

- Over14 million Americans have lost their health

insurance;

- median household income has gone down by nearly

$9,300;

- over 6 million manufacturing jobs have been lost;

- over 20 million

American workers have lost their pensions;

- wages and salaries are now at the lowest

share of GDP since 1929

- Federal debt is over $10 trillion

These figures are understated, for the government manipulates the figures, such as excluding energy, food, and other costs increases from

their calculation of the rate of inflation.

| UNEMPLOYMENT--red is gov, blue is real |

|

| A measure of misery |

Teddy Roosevelt's advice that, "We must drive the special interests out of politics. The citizens

of the United States must effectively control the mighty commercial forces which they have themselves called into being. There

can be no effective control of corporations while their political activity remains."

Don’t miss the collection of Pod Cast links

Nothing

I have seen is better at explaining in a balanced way the development of the national-banking system (Federal Reserve, Bank

of England and others). Its quality research and pictures used to support its

concise explanation set a standard for documentaries--at http://www.freedocumentaries.org/film.php?id=214. The 2nd greatest item in the U.S. budget

is payment on the debt.

|

|

|

|