|

CRASH 2008-09 -- first wave |

|

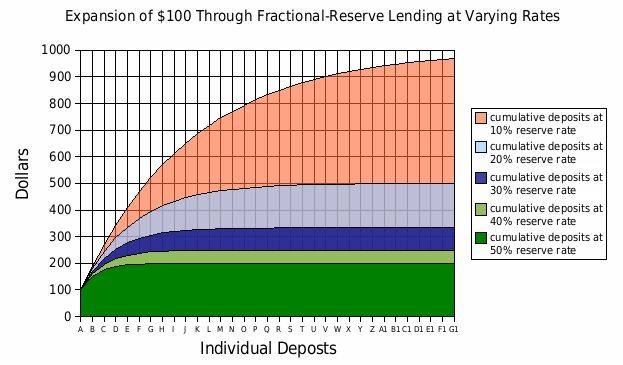

10 to 1, the Credit Expansion

10 for 1 credit expansion The current conditions gradual developed through the expansion of currency

(printing money and distributing it through the Federal Reserve Bank system to their member banks and to brokerage houses). Member banks receive $10 for each $1 held in reserve. Thus suppose the Great Pyramid gets a million in deposit more

than withdrawals each month, and it is held in reserve in their vault (or it can be deposited with the San Francisco Federal

Reserve Bank). The Federal Reserve the wires the Pyramid bank $10 million in

funds as a line of credit which it then loans out. Now suppose each month the

Pyramid Bank receives $80,000 as interest on the $10 million loaned out after deducting expense related to the loans. With that $80,000 each month the Pyramid Bank goes to the Feds and borrows another

$800,000. Take a look at the chart on above and you see the pyramid keeps expanding. Flushed with funds various ways of distributing these funds as loans (with

interest charged) were developed. Principle ways including credit cards, home

equity loans, and though the reduction in requirements for business and residential loans.

In order to facilitate the flow of funds the Federal Reserved lowered interest rates, thereby making loans through

the member banks more affordable. Thus for example a bank could make loans to

credit card holders and receive 15% or more per year on funds that cost them less than 3% per year. Moreover the $1 million in liquid deposits put aside entailed that they receive $10 million for to loan

out. Thus on the original $1 million in deposits there is a return of $1.5 million

per year—or more. With housing the banks would bundle mortgages and sell

them, thus with the funds received they could go back to the Feds and borrow more money.

These methods of expansion of and distribution of currency are practiced

around the world.

Two Critics: Ralph Nader, Inflation

and the Federal Reserve (1999): And here he is (Alan Greenspan), widely known as a fierce watchdog against inflationary

trends, yet he is remarkably selective in what kind of inflation he is against. For example, he now recognizes stock values

along with housing values as mainstays of our economy. The prices of stocks have risen vastly more than the prices of housing

over the past six years. Yet apart from some vague mumblings, he seems to be viewing prices of stocks as outside the realm

of an inflationary trend. Other numbers are also going up but they are clearly outside the conventional definitions. Corporate

welfare disbursements and preferences [tax breaks] are proliferating in every direction at all three levels of government,

totalling hundreds of billions of dollars a year. The percentage of the working poor that is under the poverty level is at

a record high...More families are making less in inflation-adjusted income than families did in 1970...Nor is he above inflating

one indicator -- interest rates -- in order to deflate other parts of the economy -- a maneuver that doesn't affect large

corporations as it does consumers and small businesses. The Fed Chairman does show consistent concern about one inflationary

indicator -- any rise in ordinary wages -- and he is regularly relieved to see that they have been "stable," even though labor's

productivity has been up sharply recently. It is clear that he loses little sleep over workers not sharing in the massive

profits that their companies are reaping. |

|

|

A solution: The problem is that by having the wolf run

the hen house, the wolf serves its own interests first. In the immediate case

bankers run the Federal Reserve System with minimal oversight that has become significantly less as the neoliberal ideology

has gained ever greater control of government policy. They argue for the removal

of all controls of the banking system, except for bailing them out.

Is the system needed? In a series of article there is set out fundamental

problems with the Don’t miss the collection of Pod Cast links Nothing

I have seen is better at explaining in a balanced way the development of the national-banking system (Federal Reserve, Bank

of England and others). Its quality research and pictures used to support its

concise explanation set a standard for documentaries--at http://www.freedocumentaries.org/film.php?id=214. The 2nd greatest item in the

|