|

| In Jan 2013 total debt surpassed $16 trillion |

|

The Corporatist State & Globalization Exposed:

proof that it is worse than you

supposed --1/23/13

By JK 6/07, updated 12/08, 5/09, 12/11, expanded 1/13 at http://www.skeptically.org/wto/id25.html

There is a monstrous enemy of the people afoot, unfettered capitalism (UC hereafter). UC has

been pushed upon all nations by the corporate giants--first among them is the financial sector (banking/banks hereafter). UC

is dressed in the economic-market theory of neoliberalism. It is neither new nor liberal. Neoliberalism is a theory that supports unregulated economic activity (laissez faire

capitalism, UC), which because of the of corporate influence is taught in universities

and praised in the corporate media. Once we had divine-right of kings and Papal

infallibility to justify the unjustifiable, now we have neoliberalism to justify

the global-ruling elite. It is bull used to justify the 2nd era of Robber Barons (the first ended with the Great Depression). Corporations haven’t changed. Don’t swallow the

spin of the ruling elite.

The US corporate press has rewritten the history of the struggle to control banking and thereby the function of government as to whom is served first. The power

to control credit entails the power to control the economy. Tighten credit and

the economy crashes; and then comes foreclosures and bargain buyouts, which benefit the giants in each sector of the economy. The founding fathers knew of this because France and England had private national

banks. They hotly debated this issue. Twice

Congress voted for a private national bank; then voted not to renew their charters

in 1811, and again in1836. The control of banking had been lost with the death

of Lincoln, who had warned that he feared the bankers more than the Rebel Army. The failure of governments to serve the people first is a result of organized

private banking.

The globalizers’ success in dismantling the populist, Keynesian economics

practices starts with the Bretton Woods Agreement (System) adopted by all 44 Allies in 1944.

It created a global financial system with the US dollar (then backed by gold) as the standard of exchange. This accord set up the World Bank (then called the IBRD) and the IMF.

The process of globalization accelerated out of this accord which favored the giants of banking. Their control of credit has made them on a global scale the shadow

government. Following the 2007 implosion of finance, the carte-blanch bailouts

through the process of reflation which occurred in every developed nation proves who is in control. The former

CEO of Goldman Sachs, Henry Paulson was our Treasury Secretary (2006-09 under Obama & Bush). The present Secretary, Timothy Geithner (former President and CEO of Fed Reserve Bank of NY) worked under Paulson in creating the bailout programs--welfare without oversight. We bear the burden

through debt payments for the over $5 trillion (09-13) increase in federal debt--mostly carried by banking. Social services are being cut as payments on federal debt rises.

The Feds pay over $500 billion a year of our taxes in interest on debt. But

what else is to be expected from the shadow government which is too big to fail?

The shadow governments, with their control of finance and NATO militaries, have

established a new-world order. Political contributions, trade treaties, loans,

and economic sanctions are tools of “persuasion”—and when that fails there is regime change. In the third world loans are mainly through the IMF and World Bank to the under developed country who are

signers of and adopt the policies of these trade treaties. These treaties call

for deregulation (UC), which they call liberalization.

The flat-world treaties of the

globalizers are given acronyms such as NAFTA, CAFTA, AFTA, and MEFTA, which are signed by both underdeveloped

and developed nations. In the NAFTA treaty—as in the others--there is 900

pages of clauses. These treaties require much more than no tariffs: the opening up the resources, the banking, the media, the utilities, the borders, and their very market

places to foreign buy outs and competition. The UC clauses require an overriding of national environmental, safety, drug, labor, commerce, and tariff laws. And

NAFTA has its own court system to accomplish this! These clauses and the conditionality attached to loans require the privatization

of government services such as the water works, social security, post office, schools, prisons, and even the military. In

The US the White House and Congress have been gradually implementing these clauses.

The power of the globalizers has caused our national sovereignty to be signed away, and their corporate press is essentially

silent over the treaties reach.

5) While the elite tell us to blame

the corporate heads, it is the corporate system that produces the bad results. Standard Oil and J. P. Morgan and Company did not change business practices with new

CEOs who replaced John D. Rockefeller and J. P. Morgan. We have robber-baron corporations, which is a result of the need to maximize profits. Monsanto, Merck, B.P. Petroleum

all have the same goals. And they have evolved into global corporations. In the past the third world was

carved up into colonies, and nations protected their corporations and colonies with high tariffs. In 1946, starting with the Brent Woods Agreement, there was a banking led move towards the “liberalization”

of regulations (UC). The Business ethics hasn't changed, only monopoly

capitalism through these trade agreements is now played upon a board that covers our planet.

The Iraq and Afghan wars are about MEFTA—opening up the entire Middle East markets including the oil fields, banking, marketplace, and manufacturing. Both nations resisted globalization and were punished. The

war is about the resolve of the US (as a tool of the shadow government) to promote neoliberalism (called liberalization). So far 13 Middle East nations have signed all or

parts of the MEFTA package of treaties, which Europe and the U.S. are parties to. But it is more than just trade treaties: it is about a takeover

of governments by international corporations who want UC globally. Thus it is entails the crushing of populism—includes

theocracies & socialism types. There is a long list since WWII of U.S. lead

assaults against countries that have formed populist governments—resistant

to the new imperialism. Populism is about serving the people first, thus the

control of corporations, land reform, social service, banking regulations, trade

restrictions, nationalization of resources. The corporate media call this “socialism”

and drums into our heads that this is counter to freedom, thus evil.

Because of popular unrest, with over 1 million voting socialist in 1932 and an attempted

fascist coupe in 1933 backed by corporate elite, Roosevelt responded with Keynesian, populist changes

that ended corporate political domination, and established through the protection

of unions a powerful populist political voice for the people. With the marginalization of unions in the 1970s, we have returned to a blatant corporatist state, a state which promotes on global-scale neoliberal policies.

These policies have resulted in the out sourcing of jobs, the flood of cheap tariff-free goods, the flood of foreign

workers both documented and undocumented, the reduction in the pay for skilled and unskilled jobs, the breaking of unions,

reduction in requirements for benefits to employees, the reduction of government social services, and a shift of the tax burden

from corporations (many of whom have moved to tax heavens to avoid U.S. taxes) and the rich to the bottom 95%. productivity

has gone up, but buying power way down. In 1950s the husband supported

the family; the mother stayed home. Through

the corporate media, paint a rosy picture for the benefits of UC and the new Robber

Baron corporations, by using bought economists, slanted media, cook federal stats. But reality thunders a sad, sad, storm, and a sadder future.

8) In the pursuit

of their short-term profits and global interests the neoliberals expanded credit which resulted in a credit-expansion based

prosperity similar to the 1920s. Now it is like the 1930s only by our government

expanding credit have we temporarily escaped the economic collapse of 07. The $4.7 trillion in by 09 of debt has

reflated the economy (a path not taken by Hoover, but by his successor Roosevelt).

But reflation is a short-term fix, for the same casino type banking speculation hasn’t changed, nor can

it, for contraction entails collapse. The Federal Reserve policy is to flood the banks with funds based on new government debt that is expanded 10-fold through issuing new credit ($1 million

in assets become 10 in loans). It is the 10% equity requirement and going off the gold standard plus deregulation (the 1933 Glass-Steagall Act was modified under Reagan, and repealed in

1999) that has led to massive market speculations. Mostly deregulated, banks

take high-risk gambles, which pay off because of credit expansion. The problem

banking is much greater than a credit bubble. Most of the loans have been bundled

and sold to other institutions based on 3% equity. Speculative shadow banks are mostly owned by banks and have over $25 trillion in liabilities (world-wide $67 trillion as of 11/12). Shadow banks holding are highly leveraged. When the bubble burst in 2007, the US our government stabilized the markets by guaranteeing $23.7 trillion mostly in shadow banks assets (source Neil Barofsky, the special inspector general). Every-developed nation’s banks

operate like the US’s. All have a very high total debt to GDP ratio. In the U.S. total debt is over 483% of GDP ($72 trillion total debt, $14.7 trillion

GDP). It is higher than was held by those nations that have had an

economic crisis in the last 2 decades (Mexico,

Argentina 1995, and the 1997 Asian Financial Crisis. Servicing federal government

debt is now the second biggest item (over $428 billion in 07) in our budget after the military. State and local governments have similar debt payments. Our

tax dollars are feeding banks instead of providing social services and infrastructure. Our

shadow government especially banks want more and more of our money, and they get it.

And there is business and personal debt interest payments.

Neoliberal policies--especially unfettering

finance and NAFTA (both just described)--have brought our nation to the precipice, and when the US falls, so too will all

the developed nations. Our nation is being bought up by foreigners

made fat by our trade deficit ($817 billion in 06, and rising) because the manufacturing, once the foundation of our economy,

shrunk to less than 12% of employment. Falling wages are a result of rising number

of people looking for work: seniors, women, illegals, immigrants, and those

made unemployed because of outsourcing. Not

counting food and plants, 87% of items sold at Wal-Mart are imported. Credit

inflation has resulted in over $53 trillion in debts. Of corporate profits, bank’s

share is 44%. Our over 800 foreign military bases only makes sense by considering

the aspirations of the globalizing corporations and vulture capitalism. Globalization

costs us over $1 trillion annually in military spending. And though US worker productivity

has increased 45% over the last 30 years, the masses don’t benefit. The

real median income has declined world-wide. Pollution, global warming, corporate

medicine, dumb-down schools and media, all these follow from the neoliberal policies of the shadow government.

The corporate-banking shadow government follows the pattern observed by Adam Smith. Thus the globalizers want to remove the social safety net, so that our government

can make interest payments without raising their taxes. These are the results

of having the international business community as our shadow government.

A strong economy and domestic tranquility are not built on a steep pyramid of income, but on a prosperous

middle class, full employment, and social-economic justice. The U.S. now ranks

4th in GDP per capita, yet is 92nd in distribution of key benefits—UN stats (principle causes for being 92nd are the economic pyramid, the military budget, debt payments, inflated corporate

profits, and high costs of health care). Neoliberal policies have rolled back

the wisdom that got us out of the Great Depression and carried us forward following WWII: tariffs,

living wages, and strong unions. A prosperous working class buys lots of durable

goods, while those at the top primarily speculate in trading. Most of the

credit inflation since the 1970s has gone into highly leveraged trading. Banking

exists as a parasite upon the backs of labor, for nearly all the payments on debt is passed on to them. Labor provides the goods and services used by banking and its employees.

They have created a casino like economy with the banks holding the chips and making the rules, rules for finance and the corporatist state.

11) Globalizers promised better pay, cheaper goods, a strong economy, and whatever else sold the public on it. Now they say that lower wages and benefits are necessary to keep jobs here. They and the politicians, who are in their fold (Reagan,

Bush 1 & 2, and Margaret Thatcher were the most brazen) have

no regard for the truth. Thirty years of economic decline for both developed and undeveloped nations

proves the case against them. A case much worse than the CIA’s and World Bank’s manipulated stats;

and worse still because they include the parasitic income made by banking as part of the service sector. The service sector’s percentage of GDP is in the US is 79.6%, Germany 70.6%, U.K 77.7%, Mexico 61.7%, India 56.4%, Venezuela 60.4% of which the parasitic financial

activity accounts for over half of those totals. The GDP growth thus is not a

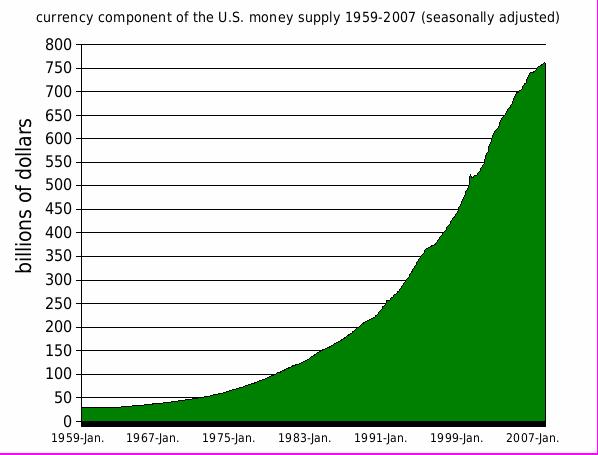

result of greater prosperity, but the results of currency expansion (see graph page 1), which results in the parasitic profits

based upon ever increasing speculation. A second deception of the GDP comes

from an underestimation of the rate of inflation (the Consumer Price Index, CPI). In

the US inflation average over the last decade is 10% (some estimate it at 12% others a bit less), but the official rate is under 3%. Thus historical comparisons are off. A final distortion as to the prosperity of the masses is that the income pyramid has

over doubled in the last 40 years; even more for the top 0.01% (see footnote). With

that wealth and their use thereof, they and their corporations own our political system.

A better measure of purchasing power and what has happened to the bottom 90% would be to calculate how many loaves

of bread can the median income worker purchase per hour of pay now and in 1973? In 1973 the average Safeway checker made $15/hour in 1973 dollars.

The troubles are not over: Greece, Italy, Spain, and Ireland are just

some of the countries to face a second round of debt based problems. And the

market has responded by buying their new government bonds at rates that strips most of its social services. Greece in Nov, of 2012 sold 10 year bonds that paid 13% interest, and a high of 37% Dec 2011. The economies of Greece and Spain collapsed under the sucking effect of the high-interest payments. If our government in a crisis was forced to roll-over its bonds (November 2012 rate

was 1.62%) at a rate comparable to Greece’s, our economy also would collapse.

In crisis assets become dirt cheap, and this creates opportunities for the vulture-capitalist

corporations. As Naomi Klein explains in her book, The Shock Doctrine, it is all scripted.

In the IMF and World Bank’s scripts are loans with conditionalities that prolong the crisis. Also in the script for the lackey governments is a military-police response to the mass’s protests--Klein

calls it the Pinochet option (dictator Chile 73-90). Economic collapse

is on our horizon, and I fear our government’s response.

SOLUTION:

The market place needs regulations:

regulations for safe and effective drugs, wholesome foods, clean air and water, safer work places, honest advertising,

product safety, accurate news reporting, and to prevent price gouging. It needs

regulations to prevent banking and speculative bubble, regulations to distribute to the workers a greater share of what their

labor produces, regulations to protect unions, and tariffs to assure a living wage. All

this is needed for a government to serve the public weal first. Such a government ought to replace the existing banking system with public banking, prohibit corporate political donations, democratize the corporations by having workers elect directors, close the speculative

markets, and replace the corporate media with one ran by public universities free of corporate influence. All this is to insure that the corporations don’t again

create a corporatist state. There is a fundamental conflict between short-term

profits and long-term economic growth, between domestic prosperity and open borders, between the aspirations of the ruling

elite and the bottom 95%, between corporate media and a true democracy, and between neoliberalism and populism. As Aristotle observed: “A democracy exists whenever those

who are free and poor are in sovereign control of the government; an oligarchy when the control lies in the hands of the rich

and better born.” Therefore don’t believe the spin

of the corporate media. The corporatist parties are about

globalization and promoting their contributors wealth. NAFTA was passed under

Clinton. Nothing will change until we dethrone the ruling elite and replace them

with a populist type of government ran by humanist who will legislate fundamental changes like those just listed above--otherwise

history will repeat itself, as it did following Roosevelt.

More readings: The long version http://www.skeptically.org/glob/id3.html; a rebuttal of the 5-basic premises in support of neoliberal (laissez faire)

economics http://www.skeptically.org/glob/id4.html; original 2007 version http://www.skeptically.org/wto/id13.html; & the solution

http://www.skeptically.org/ethicsutility/id11.html.

|

|

Topics by paragraph

1) Intro UC globalization evil afoot. Neoliberalism defined, roll back to era of Robber Barons ; pushed by global corporations,

especially banking.

2) Struggle to control banking

3) Brenton

Woods Agreement 1944 to present, foundation for finance domination & globalization

4) Shadow government, trade treaties

and loan conditionalities that promote UC

5) Corporate media blames CEOs rather

than the corporate system

6) Oil wars about MEFTA, opposition

to populist governments because they resist the new imperialism

7) Great Depression and Keynesian populism

solution, fall of unions in 1970s and return to the corporatist state

8) Expanding credit, 07 crash, shadow

banking crisis, reflation, high-debt to GDP ratio, debt payments

9) Neoliberal policies, long list of negative consequences including US world-wide bases and its costs

10) Economic

pyramid, US 4th in GDP, 92 in distribution of key benefits, currency expansion gone mostly into highly leveraged

trading, and has created the steep economic pyramid.

11) Service

sector % of GDP & bank’s share, CPI mot official 3% but around 10%, the real GDP

12) Current

crisis in Greece, Spain, opportunities for vulture capitalist corporations IMF

& World banks plans for crisis, conditionalities, and police state preparations.

13) Markets

need regulations, populist changes: v public banking, democratize the work place,

and other fixes to build true democracy

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

BOTTLENECK

There are fundamental flaws in a system whereby industrial production and the

distribution of goods are tied to the ability to pay. That ability of consumers

to pay is in conflict with the maximization of profits. Corporations’ basic

review by their board of directors as to performance is based upon the maximization of profits. In such a system profits come before a living wage and the needs of the masses. This flaw is exacerbated when the political power of corporations is not counter balanced by a politically

effective voice for the working class. With corporate media shaping the production

of ideas and no body such as strong unions who can deliver a block of votes and influence media content, voting becomes a

process of rubberstamping political parties who do not challenge meaningfully the power of corporations. With these flaws in the democratic system, a corporatist state develops, one where the corporations act

unopposed as the shadow government. And as the shadow government they act to

lower wages and benefits and to cut government programs for the masses since these come from taxes. But good wages assures good domestic demand; but we have falling wages. This

is further exacerbated by collusion in the market place which fixes prices and thereby increases the profit margin. Thus the corporate pursuit of higher short-term profits results in decreasing in diminishing markets. These are the conditions and issues found in all of the developed nations.

This contraction of demand is increased by various inefficiencies in the present

market-based system. First among them is the cost of finance, which sucks funds

from corporations, governments, and consumers. Second would be corporate profits

which have little to do with a better product. Among such costs are dividends

and profits made through the rise in the price of stocks. Third on the list would

be advertising --in some cases amounting to over 20% of costs. This should be

replaced by a method of independent testing and product ratings whose results would be placed on the package. Under the very imperfect competition system, a few corporations will grow to dominate each sector of the

economy, establish monopoly pricing, and in the develop nations expand beyond their borders.

This will evolve into global monopoly capitalism, what we have today.

Even when managed using Keynesian-populist economics, the problem of distribution

of labor and products of labor where not adequately addressed. There has been

11 recessions since WWII, and never full employment or a living wage for all workers.

With the development of the corporatist state conditions have become much worse.

The true price has been hidden for now by the expansion of debt. But there

are limits to debt expansion. The 2007 crash resulted from credit expansion/bubble. Reflation by debt expansion entail an every greater percentage of taxes and income

are going to cover the interest on the debt. Such debt payments entail ever decreasing

demand for goods and services. The next tightening of credit (what happened in

2007) should occur within the next 5 years. Reflation will then not be an effective

option. We will have a downward spiral like that during the Great Depression

when factory wages dropped 50%, and government figures for unemployment reached 25%. This

is a bottleneck where there are millions wanting to work, yet factories are operating at a fraction of capacity y because

of lack of demand, which like during the Great Depression will be created by unemployment and falling wages; viz. a lack of

consumer demand.

Corporate capitalism as a system unto itself seeks to increase profits by eliminating

competition and lowering costs. In this system there is neither full employment

nor sufficient purchasing power to assure for quality of life for the masses. The

system creates a bottle neck for the corporations want the markets to expand, yet the masses receive less, and thus demand

shrinks. Their solution is currency expansion, but this produces speculative

bubbles, and bubbles produce periods of growth and recession/depression. The

history of capitalism is dotted with these cycles. The cost of corporate capitalism

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

There

are alternatives, but they won’t become a possibility until the current system collapses and the people organized, hopefully

to support the populist alternative, and not the fascist alternative favored by corporate media and big business, as they

did with Hitler and Mussolini, and they wanted Smedley Butler in the US -- Business Plot for Fascist Coupe US 1933, General Smedley Butler—jk.

|

|

|

|

|

|

|

|

|

|

|