|

Analysis of effects of tax cuts--exposes the neocon lie

|

|

The right wing has continually made the argument that the 2003 tax cuts were

the primary driver of the current recovery. Powerline's John Hinderacker is the latest pervayer of this myth: |

|

From Huffington Post, Sept. 18, 2007 The stock market is at record highs, unemployment continues at historic lows. What's

not to like? Of course, one can always question the link between prosperity (or the lack thereof) and government policies.

But in President Bush's case, it seems pretty obvious that his tax cuts prevented what could have been a disastrous downward

spiral. At a time when our economy was subject to the double-whammy of recession and the bursting of the tech bubble, the

terrorist attacks of September 11, 2001 could easily have sent the economy into a tailspin. The

problem with this statement is it gives no mention of the effects of interest rate policy on the US economy. As I will demonstrate,

record low interest rates were in fact the primary driver of this economic expansion, not the 2003 tax cuts.

|

|

|

||

|

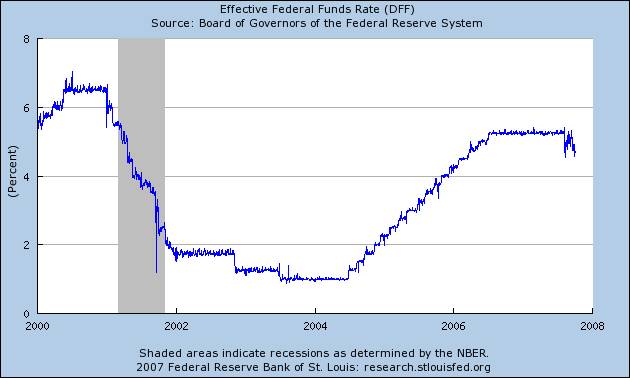

The

chart above is from the Federal Reserve of St. Louis and it is a chart of the effective Federal Funds rate. This is one of

the interest rates the Federal Reserve can directly increase or decrease at the Federal Open Market Committee meeting. Notice

the Federal Reserve started to aggressively cut the effective Federal Funds rate on January 3, 2001 when they cut the rate from 6.50% to 6%. They continued to cut the rate aggressively for

the remainder of the year. The rate dropped to 1.75% on December 11, 2001. There is a standard economic proposition that it

takes 12-18 months for interest rate cuts to move through the economy and have their maximum impact. Under this logic, the

interest rate cuts would have started to have a complete stimulative effect in the first half of 2003 which is exactly when

the US economy started to grow at a decent rate. Why

is there a lag time? There are several reasons. The first is consumers like to wait and see if the drop in rates is a permanent

change in Fed policy or a one time event. In order to ascertain the Fed's real policy intentions, consumers need to see more

economic data which takes awhile to come out. There is also the issue of when the Fed usually cuts rates. This usually happens

when the economy is already slowing or when there is a perception the economy will slow. When this happens consumers are simply

more risk adverse and are less likely to take out a loan. However,

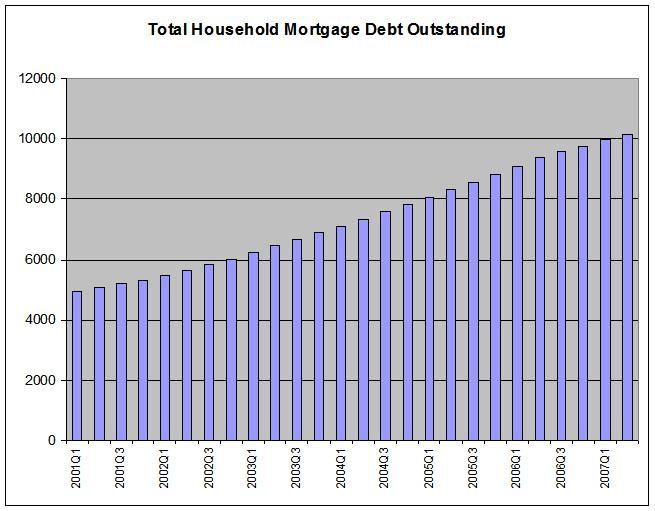

the total amount of mortgage borrowing that has occurred as a result of record low interest rates is clear from the following

chart. According

to the Federal Reserve's Flow of Funds total household mortgage debt outstanding has increased from $5.325 trillion in the fourth

quarter of 2001 to $10.143 trillion in the second quarter of 2007. In other words, US households have almost doubled their

mortgage debt outstanding during this expansion. Econ 101 explains the reasons for this massive increase in debt: when the

cost of a product is low, people buy more of it. Interest rates are the "cost of money" -- the amount it takes to borrow funds.

When

you add that much money to the economy, it is bound to grow. It's that simple. So,

no John, the tax cuts had jack to do with this expansion. Record low interest rates had everything to do with the latest expansion.

Anyone with a economic knowledge knows this. Of course, that would imply you have economic knowledge.

Must watch: Parts of Teddy Roosevelt's advice that, "We must drive the special interests out of politics. The citizens of the For the

best account of the Federal Reserve (http://www.freedocumentaries.org/film.php?id=214). One cannot understand |

|